sUSD

Your savings account on Solana

sUSD

Your savings account

on Solana

The first fully permissionless, yield-bearing stablecoin backed by a basket of T-bills.

--

Total Deposits

--

APY

--

No. of Depositors

--

Total Deposits

--

APY

--

No. of Depositors

--

Total Deposits

--

APY

--

No. of Depositors

--

Total Deposits

--

APY

--

No. of Depositors

A network of institutional and DeFi partners

Paving the way for a bankless economy

Paving the Way for a Bankless Economy with sUSD

Backed by RWA (real-world assets) and designed for both stability and growth, sUSD combines DeFi innovation with institutional reliability.

Fully Permissionless

Instant mint & redeem accessible to all.

Instant mint & redeem accessible to all.

Auto-rebase Interest

Auto-rebase Interest

The first on-chain savings account

naturally earned passive interest.

The First on-chain Savings Account Naturally Earned Passive Interest.

RWA Basket Yield

Basket of zero-risk real world asset T-bills and more.

Basket of zero-risk real world asset T-bills and more.

Securing the Open Internet

Delegate to decentralized apps (e.g. exoAVSs)

to boost security and amplify yield.

Delegate to decentralized apps

(e.g. exoAVSs) to boost security and amplify yield.

Delegate to decentralized apps

(e.g. exoAVSs) to boost security and amplify yield.

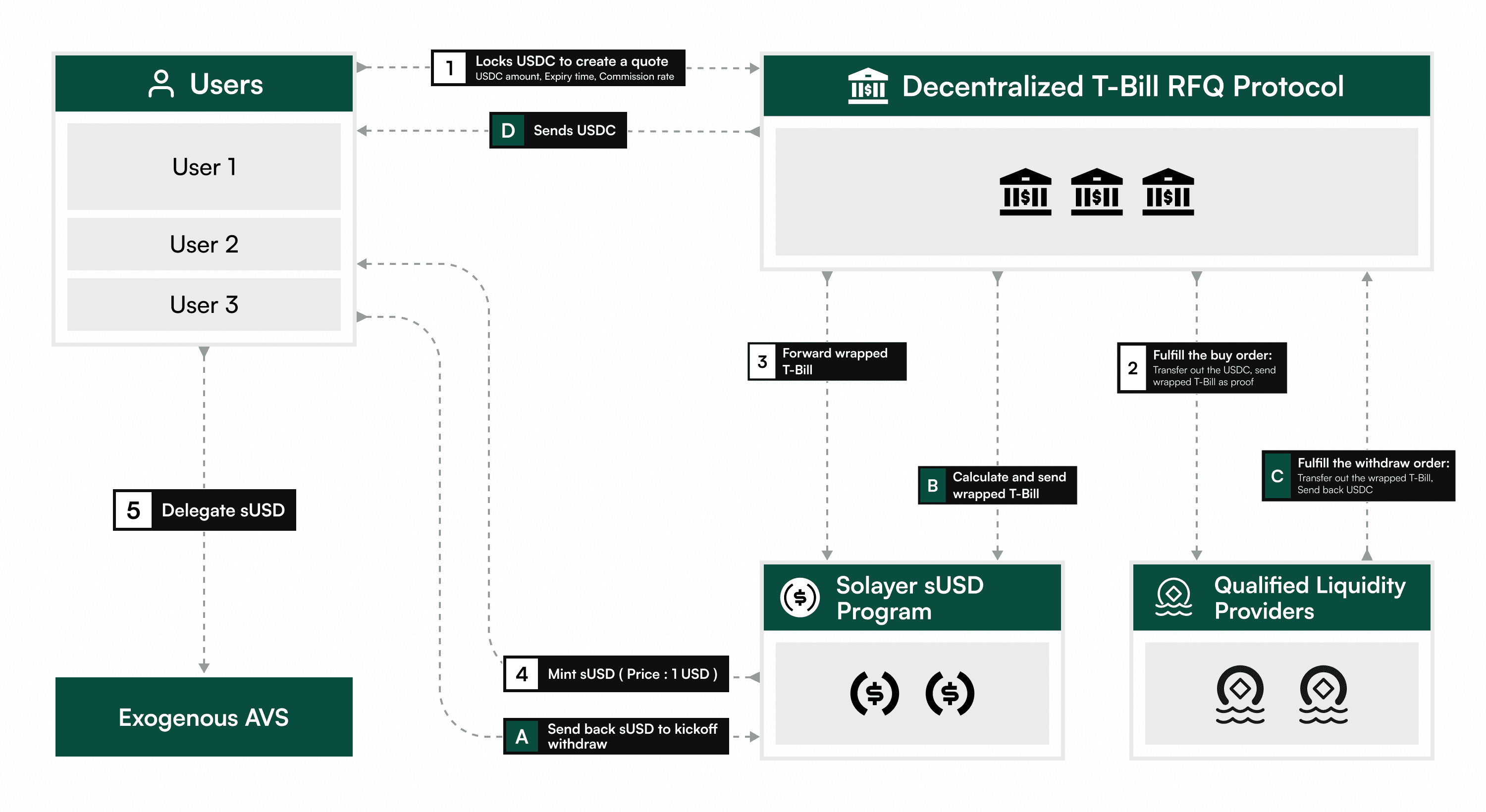

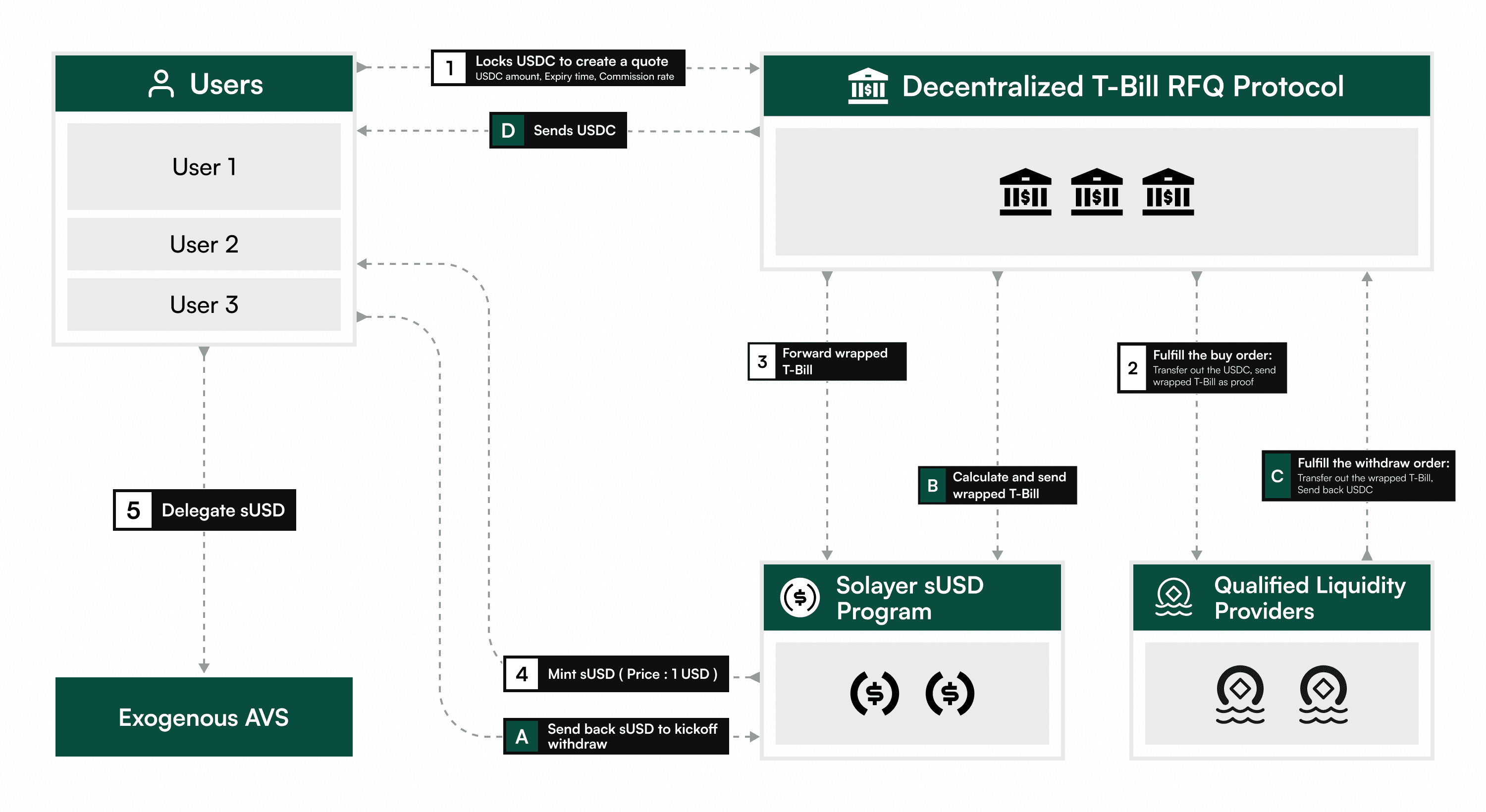

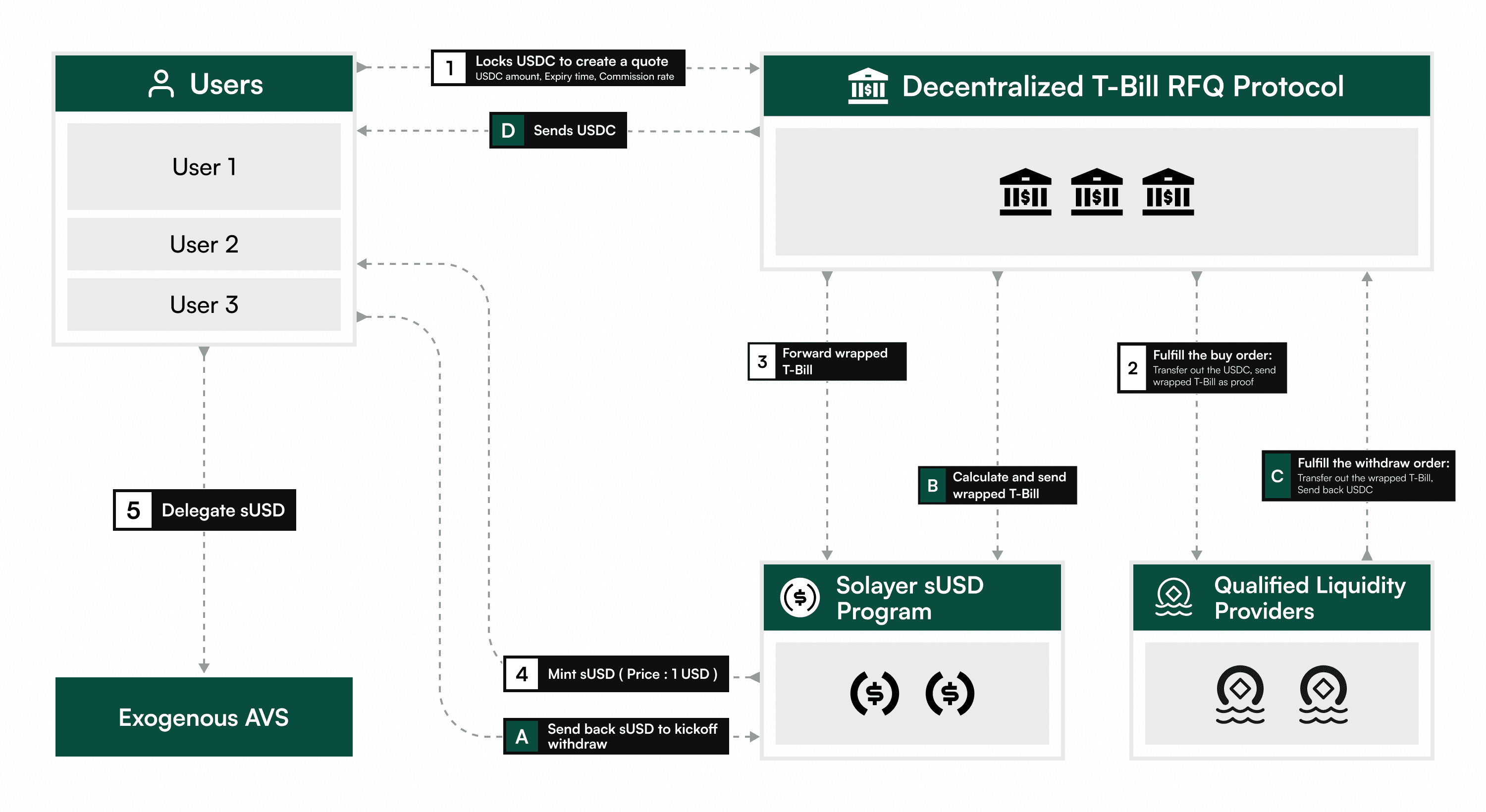

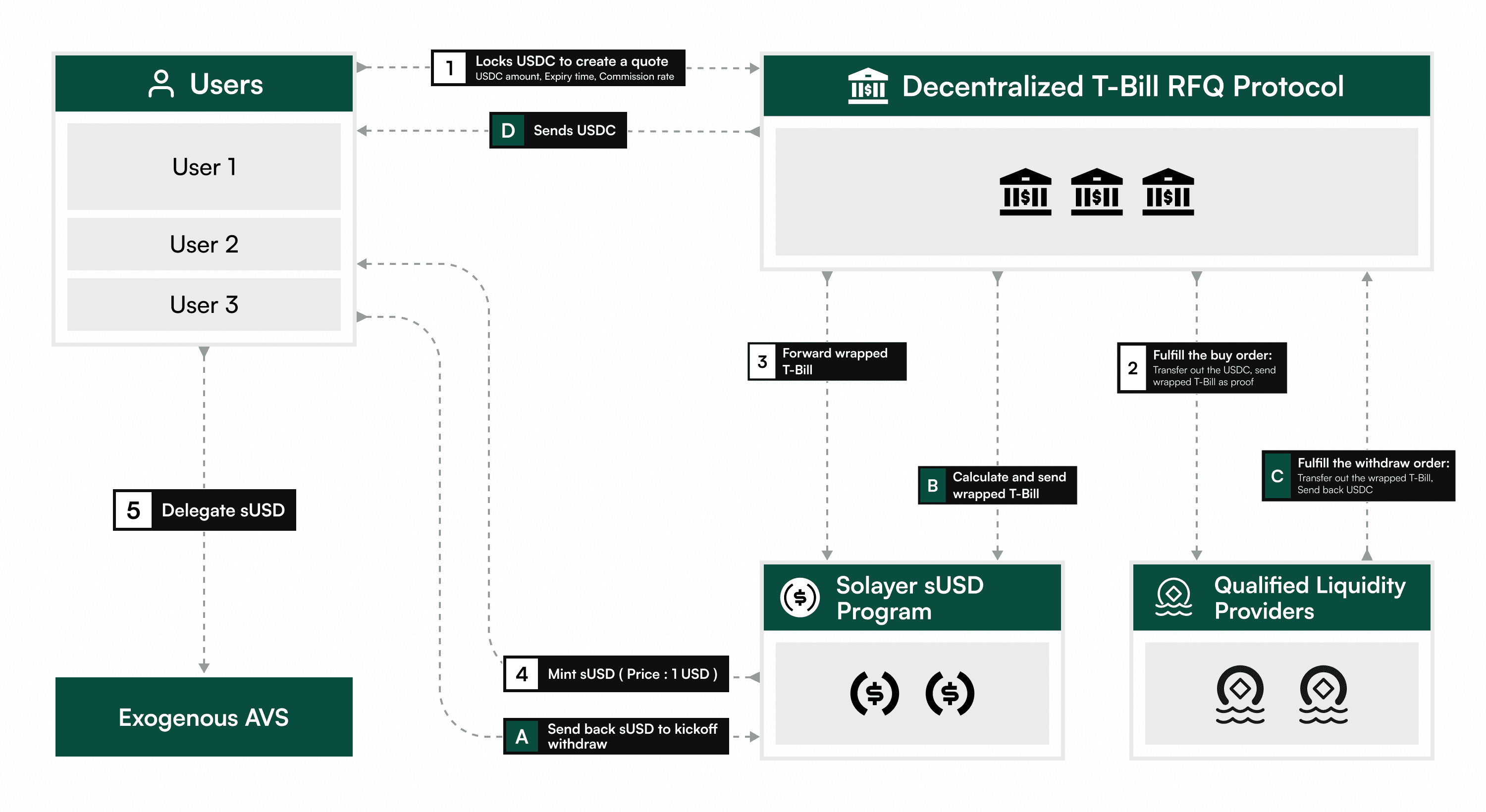

Powered by a decentralized RFQ protocol

Powered by a decentralized RFQ protocol

Powered by a decentralized RFQ protocol

The sUSD pool is designed to simplify how users earn yields from T-Bills by providing an on-chain, non-custodial request-for-quote system.

The sUSD pool is designed to simplify how users earn yields from T-Bills by providing an

on-chain, non-custodial request-for-quote system

The sUSD pool is designed to simplify how users earn yields from T-Bills by providing an

on-chain, non-custodial request-for-quote system

What can sUSD be used for?

What can sUSD be used for?

Savings Account

Securing Decentralized Systems

Collateral &Trading

Payments

Savings Account

sUSD provides a stable, yield-bearing option, allowing users to grow their assets effortlessly, similar to a high-interest savings account.

Savings Account

Securing Decentralized Systems

Collateral &Trading

Payments

Savings Account

sUSD provides a stable, yield-bearing option, allowing users to grow their assets effortlessly, similar to a high-interest savings account.

Payments

Easily use sUSD for everyday transactions, enabling borderless and stable payments within the crypto and real-world economy.

Collateral &Trading

sUSD can be used as collateral across DeFi platforms, offering a secure and stable asset for leveraging or trading in decentralized markets.

Securing Decentralized Systems

By restaking sUSD, restakers can help secure decentralized services (eg. exoAVSs), contributing to the stability of the network while earning additional rewards.

Savings Account

sUSD provides a stable, yield-bearing option, allowing users to grow their assets effortlessly, similar to a high-interest savings account.

Savings Account

Securing Decentralized Systems

Collateral &Trading

Payments

Payments

Easily use sUSD for everyday transactions, enabling borderless and stable payments within the crypto and real-world economy.

Integrate & innovate with sUSD

Power global payments, stable yields, and limitless DeFi innovation with sUSD—your gateway to permissionless finance and enterprise-grade, decentralized solutions.

Secure and trusted.

Security is top priority

Security is top priority

Security Assessment

Contract security is core to Solayer’s long-haul commitment to building secure and scalable crypto-economic infrastructure.

FAQs

Frequently Asked Questions

Frequently Asked Questions

What is sUSD?

sUSD is the first yield-bearing stablecoin on Solana. It is designed to offer a steady 4-5% yield through T-bill investments (see associated risks) while also being used to secure external systems, known as Actively Validated Services (AVSs).

How does sUSD generate yield? What is a T-bill?

How is sUSD decentralized?

Who can mint sUSD?

How is sUSD minted?

What is the RFQ mechanism behind sUSD?

How does the withdrawal process work?

What is sUSD?

sUSD is the first yield-bearing stablecoin on Solana. It is designed to offer a steady 4-5% yield through T-bill investments (see associated risks) while also being used to secure external systems, known as Actively Validated Services (AVSs).

How does sUSD generate yield? What is a T-bill?

How is sUSD decentralized?

Who can mint sUSD?

How is sUSD minted?

What is the RFQ mechanism behind sUSD?

How does the withdrawal process work?

What is sUSD?

sUSD is the first yield-bearing stablecoin on Solana. It is designed to offer a steady 4-5% yield through T-bill investments (see associated risks) while also being used to secure external systems, known as Actively Validated Services (AVSs).

How does sUSD generate yield? What is a T-bill?

How is sUSD decentralized?

Who can mint sUSD?

How is sUSD minted?

What is the RFQ mechanism behind sUSD?

How does the withdrawal process work?

What is sUSD?

sUSD is the first yield-bearing stablecoin on Solana. It is designed to offer a steady 4-5% yield through T-bill investments (see associated risks) while also being used to secure external systems, known as Actively Validated Services (AVSs).

How does sUSD generate yield? What is a T-bill?

How is sUSD decentralized?

Who can mint sUSD?

How is sUSD minted?

What is the RFQ mechanism behind sUSD?

How does the withdrawal process work?

What are exogenous AVSs?

How is sUSD different from other stablecoins?

How does sUSD maintain its 1:1 peg with USD?

What is the minimum amount needed to mint sUSD?

What happens if I hold sUSD for a long period?

How does sUSD differ from other DeFi yield-bearing stablecoins?

What comes next?

What are exogenous AVSs?

How is sUSD different from other stablecoins?

How does sUSD maintain its 1:1 peg with USD?

What is the minimum amount needed to mint sUSD?

What happens if I hold sUSD for a long period?

How does sUSD differ from other DeFi yield-bearing stablecoins?

What comes next?

What are exogenous AVSs?

How is sUSD different from other stablecoins?

How does sUSD maintain its 1:1 peg with USD?

What is the minimum amount needed to mint sUSD?

What happens if I hold sUSD for a long period?

How does sUSD differ from other DeFi yield-bearing stablecoins?

What comes next?

What are exogenous AVSs?

How is sUSD different from other stablecoins?

How does sUSD maintain its 1:1 peg with USD?

What is the minimum amount needed to mint sUSD?

What happens if I hold sUSD for a long period?

How does sUSD differ from other DeFi yield-bearing stablecoins?

What comes next?

Join the Solayer network community

Join the Solayer network community

Join the Solayer network community

Security shared through the incredibly fast Solana network to power all decentralized systems.

Security shared through the incredibly fast Solana network to power all decentralized systems.

Subscribe to all things Solayer

Subscribe to all things Solayer

solayer

Solayer is the hardware-accelerated blockchain, infinitely scaling the SVM to enable high-throughput, near-zero latency use cases.

ECOSYSTEM

Resources

©2025 Solayer · All Rights Reserved

solayer

Solayer is the hardware-accelerated blockchain, infinitely scaling the SVM to enable high-throughput, near-zero latency use cases.

ECOSYSTEM

Resources

©2025 Solayer · All Rights Reserved

solayer

Solayer is the hardware-accelerated blockchain, infinitely scaling the SVM to enable high-throughput, near-zero latency use cases.

ECOSYSTEM

Resources

©2025 Solayer · All Rights Reserved

solayer

Solayer is the hardware-accelerated blockchain, infinitely scaling the SVM to enable high-throughput, near-zero latency use cases.

ECOSYSTEM

Resources

©2025 Solayer · All Rights Reserved

Subscribe to all things Solayer