Solayer 101

Learn the basics to advance concepts of staking on Solana & restaking on solayer.

Solayer Core

Mar 31, 2024

Key takeaways

Restaking allows SOL holders to increase their yields by reusing Liquid Staking Tokens (LST) or native SOL to secure additional applications, enhancing Solana’s security for new applications like oracles or bridges.

Solana's transaction processing prioritizes transactions based on the amount of SOL staked, ensuring higher stake validators receive better performance and improving network security.

History of restaking

Onboarding the initial user base and capital is crucial for establishing the security of Proof-of-Stake (PoS) networks. This task can be particularly challenging for new base chains. However, with a total value locked (TVL) of $64 billion as of Q2, 2024, Ethereum stands out as the most secure PoS asset.

While smart contracts benefit from Ethereum's security, additional infrastructure components like oracles, bridges, and sequencers require their own economic security. Moreover, Layer 2 (L2) solutions often struggle with initial security challenges, which can be alleviated by leveraging Ethereum’s security.

Addressing these issues, the EigenLayer introduced the concept of restaking. This innovative process allows for the reuse of Liquid Staking Tokens (LST) or native ETH to secure other applications, known as Actively Validated Services (AVSs), benefiting from the underlying crypto economic security of the base chain.

The key benefits of this approach include:

Increased Yield for ETH Holders: they can amplify ETH APY by restaking it.

Enabling validators to secure multiple AVSs.

Security bootstrapping mechanism for developers.

Transaction processing architecture

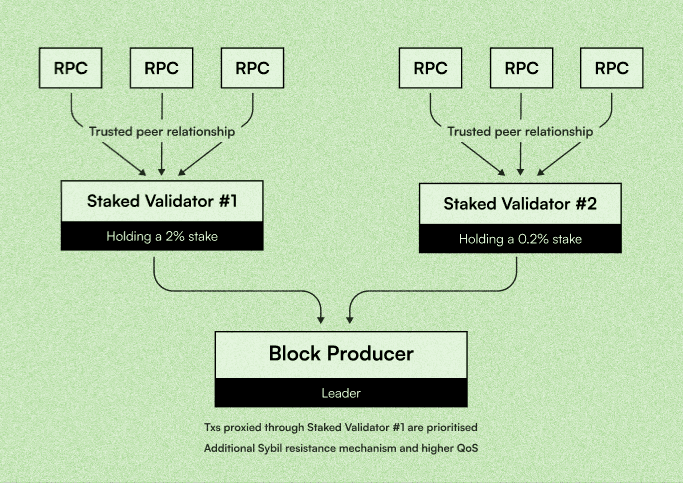

Solana's transaction processing architecture features a Scheduler that distributes transaction loads across various validators. A leader is elected for each slot to manage this distribution. The system can enable stake-weighted Quality of Service (QoS) which arrived in v1.14 of the Solana client. It allows transactions to be prioritised based on the amount of SOL staked by the submitting entity. Furthermore, validator nodes should be inclined to enable stake-weighted QoS and pair with RPC nodes if they run in a trusted environment. This design incentivizes investment in the network and aligns participants' interests with its security and performance. For example, if there are 2 validators - the first one, holding 2% of the stake and the second, having 0.2%. The former will be able to submit up to 2% of the packets to the block producer, taking priority over the latter. This will provide the higher-quality validator with better performance and increased Sybil Resistance.

Simplifying Transaction Processing

Solana has a smart way of handling transactions:

Scheduler: Distributes transaction loads among various validators.

Leader for Each Slot: A leader is chosen to manage this distribution for a specific time slot.

Stake-Weighted Quality of Service (QoS): This system prioritizes transactions based on the amount of SOL (Solana’s cryptocurrency) staked by the entity submitting the transaction.

This means, the more SOL you have staked, the higher the priority your transactions get. Validators running in a trusted environment are encouraged to use this QoS system, which benefits the network’s security and performance.

Transactions Have Weight: Think of each transaction as having weight. Heavier (more staked) transactions are more likely to get processed first.

More Stake, Better Service: The more SOL you stake, the better and faster service your transactions receive.

Preventing Spam: This system helps prevent malicious or spammy transactions from lower-quality validators.

Conclusion

Restaking on Solana via Solayer redefines economic security by enabling SOL holders to maximize their yields and contribute to the security of various applications. By prioritizing transactions based on staked amounts, Solana ensures that validators with higher stakes receive better performance, enhancing overall network security. The innovative restaking approach not only optimizes the use of staked assets but also supports the development and security of both exogenous and endogenous AVSs. This strategic enhancement fosters a robust and dynamic ecosystem, driving the future growth and stability of the Solana blockchain.